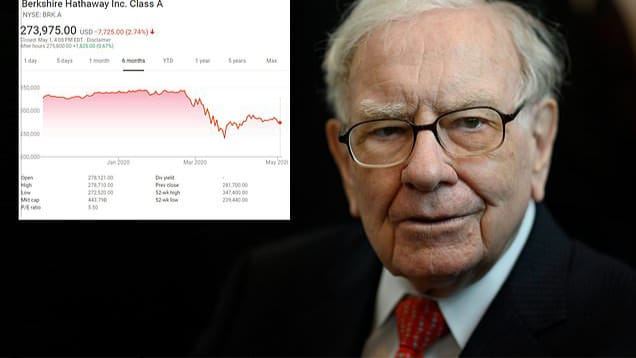

Berkshire Hathaway Inc., the renowned investment firm led by Warren Buffett, sent shockwaves through the market on Monday as its Class-A shares experienced a dramatic 99% plunge at the open. The New York Stock Exchange (NYSE) swiftly halted trading in the stock, attributing the incident to a technical glitch.

Berkshire Hathaway Shares Fall 99%

Shares of Warren Buffett’s Berkshire Hathaway Inc. experienced a dramatic 99% drop at the start of trading on Wall Street. The New York Stock Exchange (NYSE) has attributed this to a technical glitch and has halted trading in the stock. The ‘Class-A’ shares of Berkshire Hathaway, 38% of which are owned by the firm itself, were displaying this erroneous reading.

In a recent update, the NYSE announced that it is investigating a technical issue related to the upper and lower trading limits on stocks. These mechanisms are designed to halt trading when excessive volatility occurs.

Glitch or Systemwide Issue?

This incident raises concerns about the stability of the NYSE’s systems. While the exchange assures it’s a one-off glitch, it’s the second technical error impacting US markets this week. Last Thursday, a similar issue prevented price updates on the S&P 500.

Also Read: Full Blog News Here

Investigating the Cause

The NYSE is currently investigating the root cause of the glitch, similar to their efforts following a January 2023 incident where opening auctions malfunctioned.

Impact on Berkshire Hathaway

Thankfully, the dramatic price drop isn’t a true reflection of Berkshire Hathaway’s financial health. The glitch only affected the Class-A shares, with trading continuing (and showing a minor dip) for the Class-B shares, typically targeted at smaller investors.

A Reminder of Market Vulnerabilities

This incident serves as a stark reminder of the potential vulnerabilities in today’s computerized trading systems. While glitches are inevitable, ensuring robust safeguards and swift corrective actions are crucial for maintaining investor confidence.

Looking Ahead

As investigations continue, investors will be closely monitoring the NYSE’s response and potential changes to prevent similar incidents in the future. Berkshire Hathaway, meanwhile, will likely see its Class-A share price resume its normal trading range once the glitch is fully resolved.

Also Read: Which is More Profitable in 2024: Forex or Crypto Trading?

This is a developing story, and we will provide further updates as they become available.

Conclusion:

The dramatic fall of Berkshire Hathaway shares due to a technical glitch highlights the potential vulnerabilities of modern trading systems. While the incident doesn’t reflect the company’s true financial health, it underscores the importance of robust safeguards and swift corrective actions to maintain investor confidence. As investigations continue, the focus will be on the NYSE’s response to prevent similar occurrences and ensure market stability.