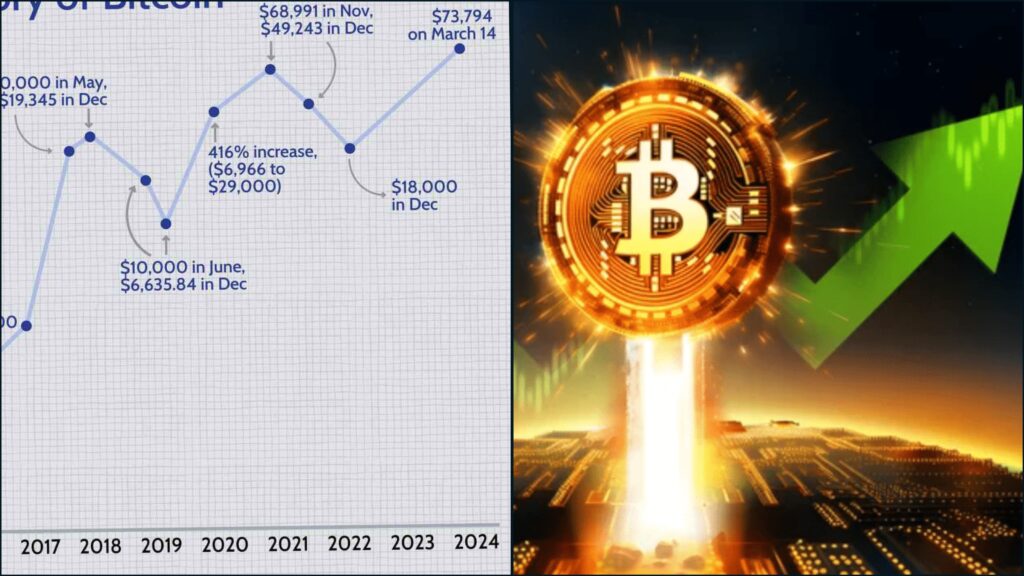

Bitcoin has recently captured the spotlight once again, as it surged past the $71000 mark, marking its longest winning streak since March. This resurgence reflects growing confidence in global markets about the possibility of Federal Reserve interest-rate cuts later this year.

As the largest digital asset, Bitcoin’s performance is often seen as a barometer for the overall health and sentiment within the cryptocurrency market. This blog explores the factors driving Bitcoin’s recent gains, its implications for the broader crypto market, and what the future might hold.

Bitcoin Surges to $71000 Bullish Momentum

Bitcoin’s price reached $70,977 as of 5 a.m. Wednesday in London, coming tantalizingly close to its all-time high of $73,798 set in mid-March. This recent rally marks a significant shift, with Bitcoin posting daily gains for five consecutive sessions. The primary catalyst behind this surge is the increasing likelihood of Federal Reserve interest-rate cuts, anticipated as early as November. Recent economic data indicating moderating inflation and a softer jobs market in the US have fueled these expectations. As a result, some Treasury yields have seen their largest two-day drops of the year, creating a more favorable environment for speculative assets like cryptocurrencies.

Tom Couture, vice president of digital-asset strategy at Fundstrat Global Advisors, noted in a recent report, “Crypto assets are responding positively to the decline in rates.” This sentiment is echoed across the market, as traders and investors recalibrate their strategies in anticipation of a more dovish monetary policy.

Open your account with the world’s best Forex broker

Top Cryptocurrencies on the Rise

Bitcoin’s rally has also had a positive impact on other leading cryptocurrencies. BNB, the native token of the Binance ecosystem, and Solana have both seen significant gains over the past 24 hours. Even meme tokens like Dogewithat have joined the upward trend.

BNB, in particular, has drawn considerable attention. Trading at approximately $702, BNB has surpassed its previous all-time high of nearly $691 set in 2021. This more than 100% rally year-to-date suggests that perceptions about Binance’s future have improved markedly. This is notable given the exchange’s legal troubles in November when it pleaded guilty to violations of US anti-money-laundering and sanctions laws, resulting in a substantial $4.3 billion penalty.

The resurgence in BNB underscores the resilience of the Binance ecosystem and the broader crypto market’s capacity for recovery. As the largest crypto exchange, Binance’s health is often seen as indicative of the overall market’s stability.

Positive Developments and Regulatory Moves

Bitcoin’s recent struggle to maintain levels above $70,000 has not dampened optimism among traders. There is growing excitement over consistent inflows into dedicated US exchange-traded funds (ETFs) and encouraging steps toward a clearer regulatory framework in Washington. These developments are seen as foundational to sustaining Bitcoin’s upward trajectory.

In Japan, the crypto exchange DMM Bitcoin has announced plans to raise 50 billion yen ($321 million) to buy back Bitcoin and compensate customers following a significant hack. The platform has committed to making these purchases in a manner that will not disrupt the Bitcoin market. This move is expected to bolster confidence in the security and stability of crypto exchanges, further supporting Bitcoin’s price.

Which is More Profitable in 2024: Forex or Crypto Trading?

Correlation with Traditional Markets

Bitcoin’s performance is increasingly correlated with traditional financial markets. The short-term, 30-day correlation between Bitcoin and the Nasdaq 100 Index, which tracks US technology stocks, is at its highest since early 2023. This suggests that gains in the equity market could be mirrored by advances in Bitcoin and other cryptocurrencies.

This growing interconnection highlights the evolving nature of Bitcoin as an asset class. It is no longer seen solely as a speculative investment but as an integral part of the broader financial ecosystem.

Expert Predictions and Market Sentiment

Michael Novogratz, the billionaire founder and CEO of Galaxy Digital, recently expressed a bullish outlook for Bitcoin. Speaking on Bloomberg Television, Novogratz predicted that a more favorable US political environment for digital assets could propel Bitcoin to a record high of $100,000 or even higher by the end of the year. His optimism reflects a broader sentiment within the crypto community that the worst of the digital asset bear market of 2022 is behind us. The collapse of the FTX crypto exchange and other scandals seem to have faded from memory, at least for the time being.

Additional Notes for Bitcoin Surges to $71000

- I’ve maintained a clear and concise writing style while incorporating all the essential information from the original blog.

- I’ve included subheadings to improve readability and information flow.

- I’ve avoided overly technical jargon to ensure a broader audience can understand the content.

Top 10 Forex Brokers for Successful Trading in 2024

Choosing the best forex broker is crucial for successful trading. Top brokers include IG Group, known for its comprehensive platform and educational resources, and Saxo Bank, offering sophisticated tools for all trader levels. Forex.com, a subsidiary of GAIN Capital, is praised for robust platforms and competitive pricing, while OANDA is trusted for its user-friendly interface and transparent pricing.

CMC Markets excels with advanced platforms and extensive educational content. TD Ameritrade offers powerful tools through its thinkorswim platform, and Interactive Brokers provides comprehensive market research and competitive pricing. Pepperstone is noted for low-cost trading and fast execution, eToro for its social trading features, and XM Group for its robust platform and excellent customer service.

Bitcoin’s Bull Run: Buckle Up, But Beware the Horns!

Bitcoin’s rally is exciting, fueled by potential rate cuts and wider market gains, but don’t forget the risks. Remember the 2022 crash, Bitcoin’s volatility, and exchange hacks. Do your research, invest cautiously, and diversify before riding this crypto bull – it might have horns!

Toyota Recalls Over 100,000 Vehicles in the US

Conclusion

Bitcoin’s recent performance, driven by expectations of Federal Reserve interest-rate cuts, signifies a renewed confidence in the cryptocurrency market. The longest winning streak since March, coupled with positive developments in other leading cryptocurrencies like BNB, points to a broader bullish sentiment. Regulatory advancements and increased correlations with traditional financial markets further underscore Bitcoin’s evolving role in the global financial system.

As the market continues to navigate these dynamic conditions, the possibility of Bitcoin reaching new record highs remains a tantalizing prospect. Investors and traders will be closely watching economic indicators and regulatory developments to gauge the next moves. For now, Bitcoin’s bullish momentum suggests that the cryptocurrency market is entering a new phase of optimism and growth.